Sudan: The rising food prices and bread crisis

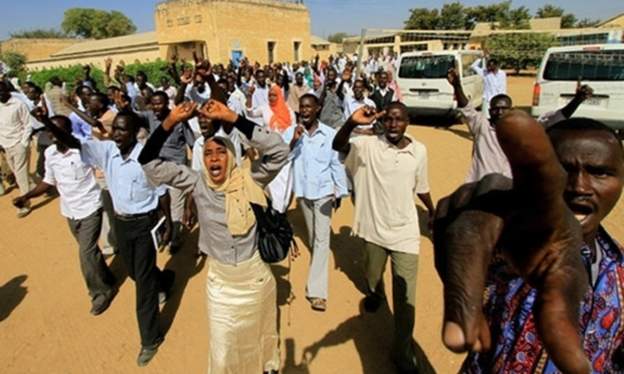

Since the beginning of January 2018, the Sudanese government has been in hot dispute. Hundreds of people storm the streets of Darfur and other big cities to protest rising food prices, including wheat whose subsidy was removed in the 2018 budget and the sector’s import private.

This decision has impacted the price of bread today doubled and rising continuously. Who is responsible for this bread crisis?

AN EXPANSIONARY POLICY OF PUBLIC SPENDING

Deprived of three-quarters of its oil resources whose prices have also fallen on the international market, Sudan is experiencing more difficulties in closing its budgets since secession with the south in 2011. For example, from 2011 to 2016, GDP growth real was on average 3.3% compared to 7.1% in 2000-2010.

In spite of the free fall of these receipts which came mainly from the exploitation of the oil, the country maintained an expansionist policy of the public expenses, by renewing the subsidy of the necessities like the wheat but also the military expenditures which were established 2.8% of GDP in 2016 according to the World Bank.

This spending propensity, encouraged by the oil windfall, pushed the rentier state to ignore the imperatives of fiscal discipline, always hoping that the oil money would hide the waste and mismanagement. The Result of the races, a budget deficit became structural for a few years with a peak in 2017 to 7.7% according to the IMF.

Faced with the deterioration of the macroeconomic equilibrium associated with this public deficit (debt, inflation,

PRIVATIZATION PARACHUTED AND WITH FUZZY OUTLINES

The decision to privatize the wheat import chain was abruptly made without any prerequisites or accompanying measures. For example, procurement procedures for private wheat imports into Sudan have not yet been made public.

The reform of the sector which is experiencing serious dysfunctions has never been mentioned. Therefore, and following the announcement of the cessation of subsidies, it is feared a tacit agreement on selling prices through a probable return of the oligopoly that existed until 2015 with

This is to the detriment of healthy competition which could have offered a favorable quality/price ratio to the populations, especially the poorest ones. With an increase in the price of the 50-kg bag of wheat flour from 167 to 450 Sudanese pounds and the ricochet of the 70-gram bread from 0.5 to 1 Sudanese pound, the populations were subjected to sudden pressure.

It is obvious that the Sudanese authorities did not choose the right timing because the situation is completely unfavorable with a high inflation rate of 35.1% recorded in the last half of 2017 and the depreciation of the Sudanese pound against dollar, further weakening purchasing power already eroded by near-permanent inflation.

Under these conditions, many bakeries and bakeries can be closed in the coming days; this will only exacerbate the tensions.

CENTRALIZED FAILING MANAGEMENT

Sudan consumes more than 2.4 million tonnes of wheat annually while domestic production covers only 15% of that consumption.

This situation can be explained by several bad choices including the subsidy at the expense of an effective policy to increase the productivity of wheat fields estimated at 583 Kg per hectare, one of the lowest and ranked 170th out of 175 performances. measured by the World Bank since 2013. Even the ambitious project “GEZIRA”, planned on 840 000 hectares irrigated by the Nile to reduce imports of agricultural products, is struggling to take off.

One of the reasons for the lack of success of the project is the excessive centralization of management of water supply infrastructure by the State. Indeed, the lack of maintenance of irrigation systems by the State causes the reduction of arable land.

Also, despite the existence in Sudan of more than 30 minerals useful in the manufacture of fertilizers and which only need to be extracted, the country imports them causing prices to flare up at the local level because of the devaluation of the pound. Sudanese.

With the introduction of a law in 2005 for the nationalization of Gezira land ownership, the state housing the project with the promise in return to compensate farmers, the insolvency situation of farmers has worsened.

Far from facilitating the exploitation by the farmers, these different shocks have demotivated them and favored the rural exodus towards the poles of petroleum exploitations where the remunerations are interesting.

A HOSTILE BUSINESS ENVIRONMENT

Despite the existence of a Ministry of Investment since 2002 to attract local and foreign investors to Sudan, local investment is struggling to take off. Better still, the construction of road infrastructures and the improvement of the business environment remain major challenges not yet identified and which make investors hesitant.

Sudan ranks 170th out of 190 countries in the World Bank’s Doing Business 2018 report , due to major weaknesses in protecting minority investors, access to credit, and cross-border trade.

For these reasons, as well as migration related to political tensions, foreign direct investment fell sharply to US $ 4.8 billion in the first half of 2017 from US $5.8 billion a year earlier, according to the Outlook report in Africa 2018. The recovery issues of the economy are therefore compromised.

By removing import subsidies, the Sudanese government is taking an accounting measure to rebalance these accounts, but this is not yet a true liberalization of the sector. Indeed, the prerequisites of such an operation have not yet been posed.

It would be beneficial for the government to put in place the structural reforms necessary for an effective liberalization of the sector at the earliest and resort to palliative measures to ease the current tensions.